Presentation of NCKU and Bank SinoPac’s Joint Research into Intelligent Finance Solutions at Atelier Future

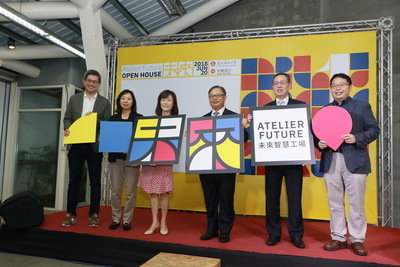

In May last year, NCKU and Bank SinoPac cofounded Atelier Future. On June 20, an AI technology research team gave a presentation detailing its achievements for its first anniversary at C-Hub, a creative workshop for NCKU faculty and students. NCKU has been collaborating with Bank SinoPac to apply machine learning to databases in the finance industry to develop new models, blockchain technology, and VR technology with the aim of incorporating them into education environments. Their objectives are to demonstrate the R&D energy of AI technology, make progress toward smart living, and pioneer the next stage of academia-industry cooperation. Their presentation encompassed 7 R&D achievements, including credit risk assessment, credit report automation, certificate blockchains, social mining, smart monitoring, wealth management, and a future campus.

Professor Darby Tien-Hao Chang at the Department of Electrical Engineering of NCKU explained that conventional financial institutions must invest significant amounts of human resources when extending credit to corporations. In the past year, the NCKU and Bank SinoPac team has been using machine learning technology, supervised learning, feature selection, and missing value imputation to develop a credit risk assessment model that can assist Bank SinoPac in recognizing, quantifying, monitoring, and managing risks derived from products and services in addition to grading credit risk and providing early warnings. With AI technology and the integration of internal and external big data, financial institutions will be able to maintain a better grasp on industry developments and reduce human misjudgment.

Professor Chang indicated that the credit risk assessment model can provide banks with reference such as credit reports, trading decisions, and credit pricing for risk management and performance evaluation. In the design of internal credit risk models, banks must consider many aspects, including credit quality and market variables. This model can improve the ability of banks to organize credit assessments.

The research team led by Assistant Professor Jen-Wei Huang at the Department of Electrical Engineering of NCKU is using the corporate financial information provided by Bank SinoPac, external data obtained online, and automatic text summarization technology to develop a news summarization system. This system will automate credit reporting by generating credit reports and scores that will simplify review processes. Assistant Professor Huang indicated that information available in the cloud is massive in quantity and for the most part irrelevant, so collating it is time-consuming and clumsy. Automatic text summarization can organize information and restructure it into a summarized format, thereby saving considerable time spent searching for and browsing documents.

Using the Chinese natural language processing technology developed at NCKU, Bank SinoPac can comb through corporate financial information and online news, perform automatic summarization of information, and obtain automatically generated credit reports. In conjunction with the credit model, it is possible to create SinoPac AI credit reports, simplify review processes, facilitate risk management, and prevent money laundering.

NCKU and Bank SinoPac are promoting certificate blockchains so that students can share and digitally document their learning processes in a secure environment protected against information tampering and counterfeiting. Assistant Professor Jim Ching-Chun Huang at the Department of Computer Science and Information Engineering at NCKU stated that the costs of inspecting the numerous licenses and certificates in the finance domain are rising; establishing a blockchain-based proof-of-existence system can reinforce private information processing procedures, and permitting other applications via public blockchains can enhance the credibility of data collection and analysis. In the future, collated data or certificates can be sold and purchased in dedicated markets and thereby create economic incentives.

Assistant Professor Hung-Yu Kao at the Department of Computer Science and Information Engineering at NCKU proposed an AI-incorporated core model for wealth management and resource allocation. The prediction model and enhanced learning methods in machine learning enable the effective prediction of fund markets and achieve profit objectives with accurate investment portfolios. Associate professor Min-Chun Hu at the Department of Computer Science and Information Engineering at NCKU conducted a multi-phased study into intelligent monitoring in finance. She led her research team in identifying individuals, tracking their movements, and predicting emotions and fields of regard using machine vision and deep learning technology to further analyze user behavior.

President of NCKU Dr. Jenny Huey-Jen Su, director of Bank SinoPac Eric Chuang, president of SinoPac Holdings Stanley Chu, and vice president of the Office of Research and Development at NCKU Dr. Sun-Yuan Hsieh attended the presentation. Dr. Su indicated that the project hopes to open up opportunities for the development and application of financial technology and implement research achievements. Mr. Chuang pointed out that the concepts and technological applications proposed by NCKU over the year have benefited SinoPac greatly. He holds high hopes for the continued benefits yielded by the collaboration between NCKU and SinoPac.

Professor Darby Tien-Hao Chang at the Department of Electrical Engineering of NCKU explained that conventional financial institutions must invest significant amounts of human resources when extending credit to corporations. In the past year, the NCKU and Bank SinoPac team has been using machine learning technology, supervised learning, feature selection, and missing value imputation to develop a credit risk assessment model that can assist Bank SinoPac in recognizing, quantifying, monitoring, and managing risks derived from products and services in addition to grading credit risk and providing early warnings. With AI technology and the integration of internal and external big data, financial institutions will be able to maintain a better grasp on industry developments and reduce human misjudgment.

Professor Chang indicated that the credit risk assessment model can provide banks with reference such as credit reports, trading decisions, and credit pricing for risk management and performance evaluation. In the design of internal credit risk models, banks must consider many aspects, including credit quality and market variables. This model can improve the ability of banks to organize credit assessments.

The research team led by Assistant Professor Jen-Wei Huang at the Department of Electrical Engineering of NCKU is using the corporate financial information provided by Bank SinoPac, external data obtained online, and automatic text summarization technology to develop a news summarization system. This system will automate credit reporting by generating credit reports and scores that will simplify review processes. Assistant Professor Huang indicated that information available in the cloud is massive in quantity and for the most part irrelevant, so collating it is time-consuming and clumsy. Automatic text summarization can organize information and restructure it into a summarized format, thereby saving considerable time spent searching for and browsing documents.

Using the Chinese natural language processing technology developed at NCKU, Bank SinoPac can comb through corporate financial information and online news, perform automatic summarization of information, and obtain automatically generated credit reports. In conjunction with the credit model, it is possible to create SinoPac AI credit reports, simplify review processes, facilitate risk management, and prevent money laundering.

NCKU and Bank SinoPac are promoting certificate blockchains so that students can share and digitally document their learning processes in a secure environment protected against information tampering and counterfeiting. Assistant Professor Jim Ching-Chun Huang at the Department of Computer Science and Information Engineering at NCKU stated that the costs of inspecting the numerous licenses and certificates in the finance domain are rising; establishing a blockchain-based proof-of-existence system can reinforce private information processing procedures, and permitting other applications via public blockchains can enhance the credibility of data collection and analysis. In the future, collated data or certificates can be sold and purchased in dedicated markets and thereby create economic incentives.

Assistant Professor Hung-Yu Kao at the Department of Computer Science and Information Engineering at NCKU proposed an AI-incorporated core model for wealth management and resource allocation. The prediction model and enhanced learning methods in machine learning enable the effective prediction of fund markets and achieve profit objectives with accurate investment portfolios. Associate professor Min-Chun Hu at the Department of Computer Science and Information Engineering at NCKU conducted a multi-phased study into intelligent monitoring in finance. She led her research team in identifying individuals, tracking their movements, and predicting emotions and fields of regard using machine vision and deep learning technology to further analyze user behavior.

President of NCKU Dr. Jenny Huey-Jen Su, director of Bank SinoPac Eric Chuang, president of SinoPac Holdings Stanley Chu, and vice president of the Office of Research and Development at NCKU Dr. Sun-Yuan Hsieh attended the presentation. Dr. Su indicated that the project hopes to open up opportunities for the development and application of financial technology and implement research achievements. Mr. Chuang pointed out that the concepts and technological applications proposed by NCKU over the year have benefited SinoPac greatly. He holds high hopes for the continued benefits yielded by the collaboration between NCKU and SinoPac.

Provider:

news center

Date:

2018-07-13